In the fast-paced world of music and media, growth is often driven not just by organic expansion but by strategic mergers and acquisitions (M&A). While initial public offerings (IPOs) have traditionally been a favored route for companies seeking to raise capital and scale their operations, mergers and acquisitions offer a faster, more controlled pathway to the public markets. Over the past few decades, several high-profile music-media companies have chosen to go public via M&A deals, capitalizing on the opportunities that come with joining forces with existing public companies. This article delves into notable examples of music companies that went public through mergers and acquisitions and how these deals reshaped the landscape of the music and entertainment industries.

SiriusXM and Pandora: A Strategic Merger

One of the most notable mergers in recent music history is SiriusXM’s acquisition of Pandora. In 2018, SiriusXM, already a public company and a leader in satellite radio, acquired Pandora, one of the largest streaming music services in the U.S., in an all-stock deal valued at $3.5 billion. This merger allowed SiriusXM to expand its reach beyond its satellite radio platform and into the digital streaming space, making it a direct competitor to companies like Spotify and Apple Music.

Pandora, which had struggled to maintain profitability in a competitive streaming market, saw the merger as an opportunity to stabilize its operations and leverage SiriusXM’s strong subscriber base and financial resources. For SiriusXM, the acquisition represented an opportunity to tap into Pandora’s massive audience and digital ad revenue streams.

The merger enabled Pandora to enter the public markets under SiriusXM’s umbrella, without the need for its own independent IPO. For investors, the deal offered a chance to be part of a more diversified company that spanned both satellite radio and digital music streaming, providing growth potential in both arenas. Since the merger, SiriusXM has worked to integrate Pandora’s streaming service into its broader ecosystem, allowing for cross-promotion and an enhanced listener experience across platforms.

Vivendi’s Universal Music Group and SPAC Merger

Another recent example of a music company going public via M&A is Universal Music Group’s (UMG) merger with a special-purpose acquisition company (SPAC). In September 2021, UMG, the largest music label in the world, completed a deal to go public by merging with a SPAC set up by Pershing Square Tontine Holdings, the investment firm run by billionaire Bill Ackman.

This transaction was unique in that UMG did not follow the traditional IPO route, instead opting to merge with the SPAC as a way to enter the public markets. The deal valued Universal Music at a whopping $40 billion, allowing Vivendi (UMG’s parent company) to spin off a significant portion of UMG as a standalone public company listed on the Euronext Amsterdam stock exchange.

The decision to go public through a SPAC merger was driven by the increasing demand for music rights and the explosion of streaming services. UMG’s catalog includes legendary artists such as The Beatles, Taylor Swift, and Drake, making it a highly valuable asset in a world where music rights are becoming more lucrative due to streaming and licensing deals. The merger provided investors with an opportunity to own a piece of one of the most iconic and profitable companies in the music industry without the uncertainty that sometimes accompanies traditional IPOs.

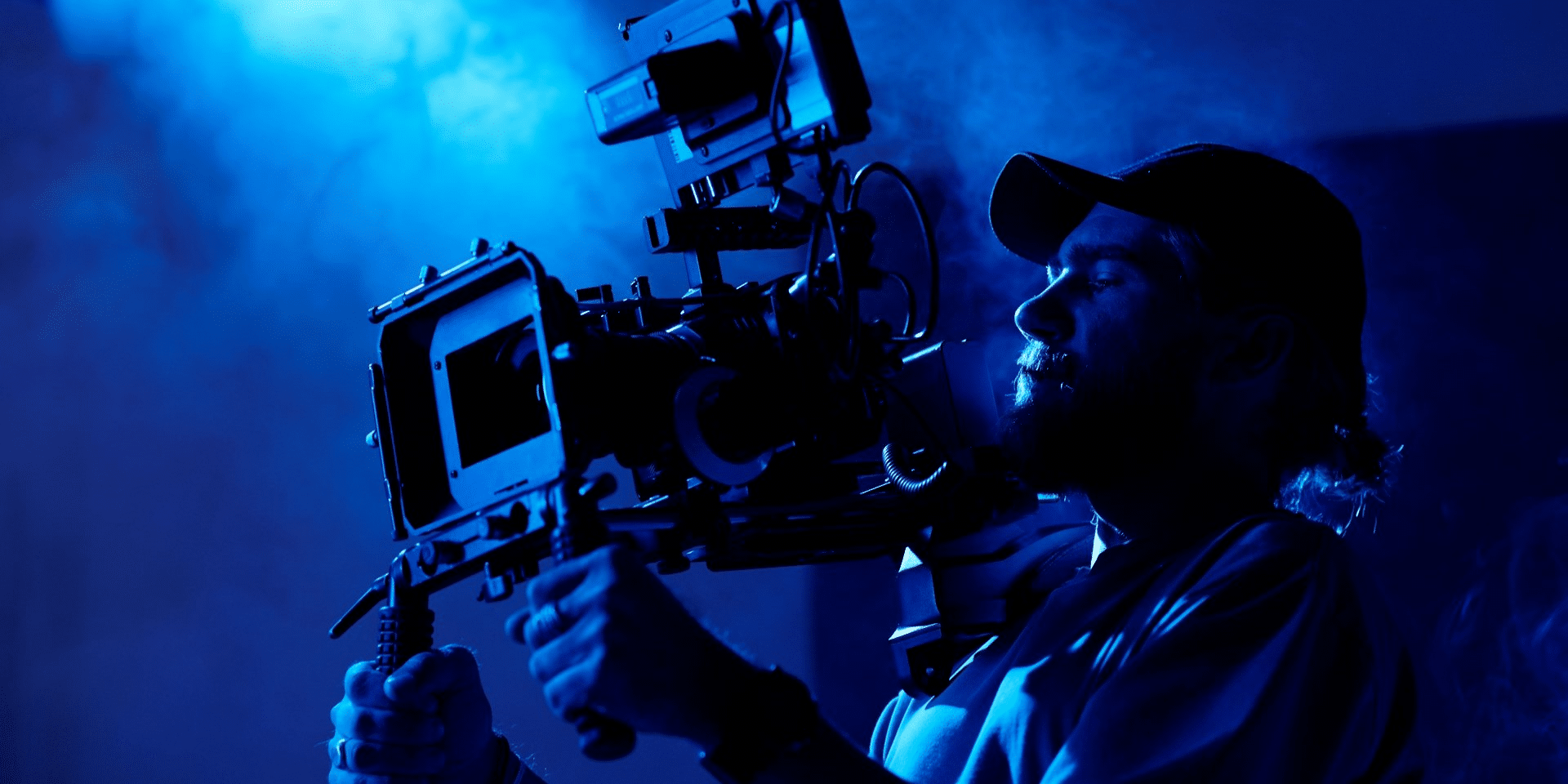

Photo: Unsplash.com

Spotify’s Acquisition of Anchor and Gimlet Media

While Spotify had already gone public via a direct listing on the NYSE in 2018, its subsequent acquisitions played a crucial role in expanding its public presence and dominance in the podcasting space. In 2019, Spotify made headlines by acquiring Gimlet Media and Anchor—two major players in the podcasting industry—for a combined $340 million. While this move didn’t directly involve taking either company public, it highlights how Spotify used acquisitions to strengthen its public market position and diversify its content offerings.

By integrating these podcasting companies, Spotify was able to pivot from being a primarily music-focused platform to a broader media company offering a wide range of audio content. Podcasts became a key pillar of Spotify’s growth strategy, and the acquisitions gave the company access to exclusive content and podcasting technology that set it apart from its competitors.

For Gimlet Media and Anchor, the acquisition by Spotify brought them into the public eye, as Spotify’s stock market performance was increasingly driven by its success in the podcasting space. This merger demonstrates how strategic acquisitions can play a pivotal role in shaping a company’s direction post-IPO and expanding its offerings to capture new market segments.

The Rise of Music Rights Companies: Hipgnosis Songs Fund

Another trend in the music industry’s M&A activity is the rise of music rights companies, which have gained immense value in the streaming era. One standout example is the Hipgnosis Songs Fund, a UK-based company that went public on the London Stock Exchange (LSE) in 2018 through a reverse merger. Hipgnosis has since become one of the largest investors in music catalogs, acquiring the rights to songs from legendary artists like Neil Young, Fleetwood Mac, and Shakira.

While Hipgnosis did not go public via an IPO, its use of a reverse merger to list on the LSE exemplifies how music rights companies can leverage financial markets to raise capital and acquire valuable catalogs. The public listing has allowed Hipgnosis to raise hundreds of millions of dollars to invest in music rights, capitalizing on the increasing demand for streaming revenue and licensing opportunities.

The company’s growth strategy is built on acquiring long-term rights to popular songs, which generate steady revenue from streaming, radio play, and licensing deals. This reverse merger allowed Hipgnosis to tap into public markets to fund its acquisitions, demonstrating the growing importance of music rights as an asset class.

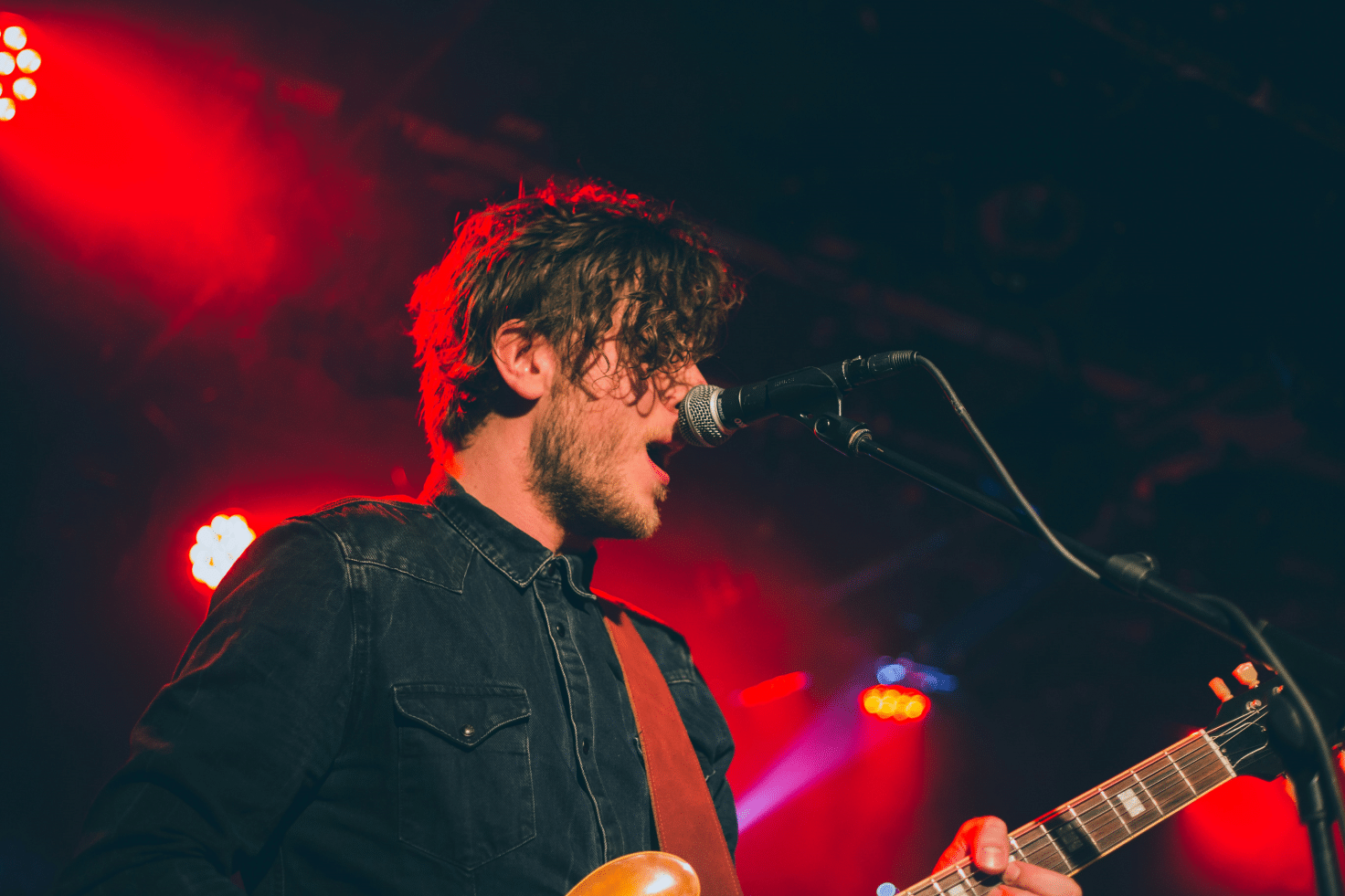

Photo: Unsplash.com

Conclusion: Mergers and Acquisitions as a Path to the Public Market

While IPOs are the traditional route for companies looking to go public, mergers and acquisitions offer an alternative path that has proven successful for many music-media companies. Deals like SiriusXM’s acquisition of Pandora, Universal Music’s SPAC merger, and Spotify’s podcasting acquisitions highlight how M&A can help companies expand their public market presence and diversify their offerings.

As the music industry continues to evolve, particularly with the rise of streaming, music rights, and podcasting, we can expect to see more mergers and acquisitions as companies look to scale and adapt to new market demands. Whether through direct IPOs or strategic M&A, the convergence of music and media is reshaping how companies access public markets and raise the capital needed to thrive in a digital-first world.

Published by: Martin De Juan